Our latest news and analysis.

Business Sale Case Study: PR Packaging.

CFSG commenced business sale discussions with PR in January. The parties completed a confidentiality agreement and PR provided CFSG with high-level financial information on its business. This enabled the parties to have preliminary discussions around realistic valuation expectations and potential acquirers. A formal engagement was signed in February and CFSG began the process of selling the business in May. PR was successfully sold in December.

Information Gathering & Business Analysis

On signing the engagement, CFSG provided PR with a detailed questionnaire seeking a wide range of information on the business. This included information around the business’ ownership and corporate structure, business model & strategy, customers & suppliers, plant & equipment, employees, premises & facilities, sales & marketing as well as historical and forecast financial information.

(4 weeks).

Strategy Development

As the requested information came to hand, CFSG held detailed discussions with PR around a broad transaction strategy, including likely potential buyers for the business. This carefully considered “hit list” comprised key industry players. At least one potential buyer was excluded due to its reputation for untrustworthiness.

(2 weeks).

Legal, Accounting & Tax Advice

As the information gathering process was underway, CFSG also held several discussions with PR’s accountants. These discussions focused on understanding and allowing for any potential tax implications of a transaction. This was a crucial aspect of the transaction given the owner intended to retire post transaction.

(1 week)

Material Preparation

CFSG simultaneously began preparing three separate marketing documents for distribution: a “flyer” that provided a no-names snapshot of the business, a deidentified historical Profit & Loss and a more detailed business profile (“Profile”). Multiple drafts of these documents were prepared and shared with PR.

(4 weeks)

Due Diligence Preparation

CFSG provided PR with an additional questionnaire: a list of due diligence documents that were required. As that material was provided, it was placed in a virtual data room maintained by CFSG.

(concurrent / ongoing)

Targeted Distribution

CFSG commenced marketing in mid-May. CFSG directly telephone called each company on the “hit list” with the initial goal of assessing potential acquirers’ level of interest in the opportunity. All discussions at this stage were on a “no-names” basis and focused on using the flyer for background information.

Importantly, throughout the marketing process, CFSG kept PR fully informed of all developments. No material or information was shared with any party without PR’s full consent. Further, CFSG provided PR with a formal, detailed campaign update on a weekly basis.

(2 weeks)

Information Exchange & Face-to-Face Meetings

Several interested parties were also provided with the “no-names” P&L. From there, the remaining Interested parties completed confidentiality agreements before being provided with the Profile.

Two parties conducted site visits and sent through multiple rounds of further information requests. Both prospective purchasers put forward non-binding indicative offers (“NBIOs”) to acquire PR.

CFSG and PR carefully analysed both NBIOs and agreed to engage further with only one party, Ayres Packaging.

(4 weeks)

Offers & Negotiation

CFSG held multiple rounds of further negotiation with Ayres. A key challenge remained agreeing on mutually acceptable transition arrangements given the number of PR staff who were family members looking to exit the business on completion. The discussions eventually arrived at a proposal that was acceptable to PR’s owners in October.

(12 weeks from first NBIO)

Legal Agreements

On signing a heads of agreement, PR granted Ayres exclusivity. PR provided Ayres with draft legal documents, including the key business sale agreement. CFSG and PR engaged with PR’s lawyer to negotiate and arrive at acceptable terms for each of these agreements.

(6 weeks)

Due Diligence

On being granted exclusivity, Ayres formally commenced conducting due diligence on PR. This included a detailed review of legal, commercial and financial information. No material issues were identified.

(concurrent)

Closing

CFSG assisted PR’s lawyer to facilitate settlement of the transaction, which completed in December 2022.

(11 Months from signing engagement)

—

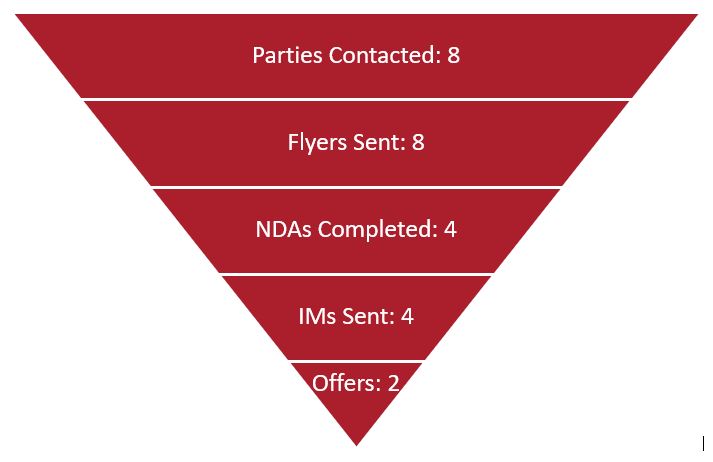

Campaign Metrics

Below are the key metrics from the PR marketing campaign:

To discuss how CFSG can assist you in buying or selling a business, please don’t hesitate to contact us.