Our latest news and analysis.

The Opportunities That Appeal to Growth Capital Investors.

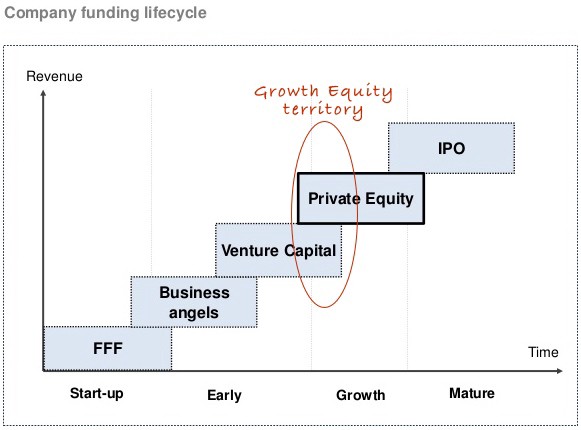

To better understand the sorts of investment opportunities that appeal to growth capital investors, it is necessary to first be clear on where and how growth capital fits into the broader investment landscape.

The two most high-profile moments in the life of a fast-growing business is when the company receives its early funding, often from venture capital (“VC”), and when it achieves an exit through an IPO or trade sale. While these events tend to dominate the headlines, there is an intermediate funding stage that is arguably just as important that tends to go by unnoticed: growth capital.

Growth capital, which is a sub-set of private equity (“PE”), focuses on providing established, fast-growing businesses with the equity capital, expertise and networks they need to take what can be described as a transformational leap in their development. This transformational leap builds company value by propelling the business along the path to becoming an attractive IPO or trade sale candidate.

In contrast to growth capitalfunds, VCs typically focus on relatively smaller minority investments in early-stage businesses. These companies are typically pre-profit, often pre-revenue and even occasionally pre-product. As a result, VC investors specialise in making high-risk/high-return bets that their capital will enable an entrepreneurial team to seize a nascent market opportunity. Given the early nature of these businesses, the holding period can be anywhere from five to 10 years.

At the other end of the PE spectrum are buy-out funds. These funds acquire substantial majority stakes (often close to 100% interests) in large, proven businesses with predictable cashflows. These predictable cash flows are key to enabling an acquired business to shoulder the large debt burdens that are a common hallmark of these transactions. Buy-out funds tend to hold investments for between three and five years.

The reality is that all PE deals sit on a continuum from VC investments to growth capital transactions and all the way through to buy-outs. In practice, the precise distinction between a growth capital deal and, say, a later-stage VC investment or a majority buyout that leaves the founders with a substantial capital interest and continuing executive duties, can be somewhat blurry in practice.

Because growth capital funds are seeking growth opportunities, they tend to focus on select sectors of the economy – sectors that have strong structural tailwinds that are supported by widely accepted investment cases. For example, one common ‘thematic’ is information technology. A recent report by research company Gartner estimates that global IT spending will hit US$3.8t by 2020 with strong growth coming from the shift towards the cloud.

These dynamics make software technology an attractive catchment for growth capital opportunities. For example, PE giant KKR announced in 2016 that it was launching a dedicated US$700m+ information technology growth fund to scour the globe for growth opportunities across technology, media and telecommunications. This fund sits alongside other dedicated KKR growth funds such as the firm’s US$1.45b healthcare growth fund – another common theme for growth capital investors.

Identifying growth capital opportunities

Growth capital funds will typically identify a “sweet spot” in terms of the transaction size that most strongly resonates with them and the risk appetites of their investors. This will commonly be expressed in terms of “cheque” size – or how much equity a fund will need to deploy to complete the transaction. That cheque size is a function of a target’s valuation, which is determined usually via a multiple of revenue and/or EBITDA. Growth capital funds will also have pre-set minimum and maximum sizes of investment that is determined by their mandate.

Assuming an opportunity meets a fund’s size requirements, probably the immediate concern of a growth capital fund is to establish that a target company is, indeed, fast-growing – at least compared to its peers. Ideally, that growth will be evidenced by rising revenue and earnings as well as other key industry-specific metrics such monthly recurring revenue (‘MRR’) or average revenue per user (‘ARPU’). Companies with declining revenues will find it much harder to attract growth capital interest.

After assessing a company’s growth profile, the next priority for growth investors is being convinced that the company’s underlying competitive advantage is sustainable. While investors are always attracted to a business with high growth, it is important that such growth will persist over time in the face of competition. This assessment is based on detailed analysis of the relevant company’s market and strategic position.

The next key selection criteria is to assess the perceived strength of the founders and management team. While in a buy-out scenario, a PE might decide to install a new management team as part of its strategy, a growth investor, particularly with a minority interest, is overwhelmingly backing the company’s existing founders and management to continue growing the business. There may be identified gaps in skills and room for mentoring, but the basic management raw material must already be there.

A company may meet a fund’s size and growth requirements but may still fail to be an attractive investment candidate. One common reason for this is that a company is deemed vulnerable to ‘exogenous’ forces. Examples of this are businesses that operate in, say, mining, agriculture or property development. A decline in commodity prices, an extended drought or a step-change in interest rates – forces all outside of management’s control – can inexorably destroy shareholder value.

Another reason that a growing business may not be an attractive growth capital candidate is because of its perceived capital intensity. Many businesses rely on large and ongoing investments in plant & equipment to grow, which reduces their ability to scale quickly and cost-effectively. Given that growth capital funds aim to exceed minimum internal rates of return, the quicker and more capital efficiently a business can grow, the more attractive it will be to a growth capital fund.

Growth capital is increasingly being recognised as an important milestone in the development of a fast-growing software business. If you want to discuss how CFSG can assist you to effectively secure growth capital funding for your company, we invite you to get in touch.