Our latest news and analysis.

Precedent Transactions And Their Importance In Company Valuations

A key question for the prospective seller of any business is what their company might be worth. One way of attempting to assess that likely value is by researching the valuation multiples previously paid for comparable companies. This process is often referred to as precedent transaction analysis.

(If you would like a detailed introduction to valuation multiples, please click here).

Conducting precedent transaction analysis for a business sale is typically a five-stage process:

1. Select the universe of comparable transactions;

2. Source the necessary transaction and financial data;

3. Spread the relevant statistics and data;

4. Identify the most comparable transactions; and

5. Determine the resulting valuation.

In this post, we will walk through each of these steps and use the independent expert report (“IER”) compiled for the takeover of listed telecommunications iiNet by TPG.

1. Select the universe of comparable precedent transactions

Probably the most challenging part of conducting precedent transaction analysis is identifying a universe of truly comparable companies.

It’s the same reality as trying to triangulate the value of a home by comparing it to recent similar sales. No two homes are identical, which always makes comparisons difficult. These challenges are even more pronounced with companies of which there are far fewer sales and key details often being withheld.

Nevertheless, with tenacity and lateral thinking, it is always possible to identify a universe of comparable acquisitions.

The key is comparability between the company in question and those that have been sold. When searching for relevant precedent transactions, useful dimensions to consider include the following:

| Business Characteristics | Financial Characteristics |

| Sector | Size |

| Product / Service | Profitability |

| Business Model | Growth |

| Customers & Markets | Return on Investment |

| Distribution Channels | Indebtedness |

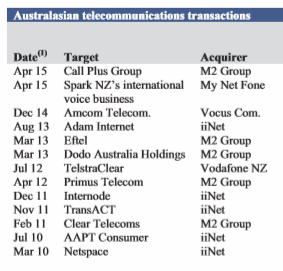

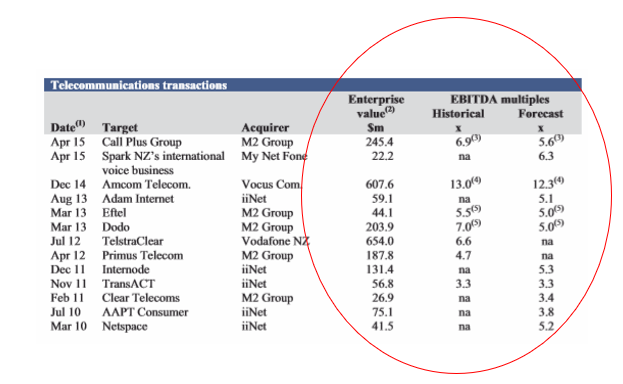

Looking at the iiNet transaction, the IER identified a universe of 13 precedent transactions that spanned a period of the previous five years. All these transactions occurred within either the Australian or New Zealand telecommunications sector and the companies concerned ranged in enterprise value from $22.2m up to $607.6m.

2. Source the necessary transaction and financial data

Once the universe of relevant transactions has been identified, it is then necessary to locate the relevant transaction and financial data.

When both the acquirer and the bidder are large, public companies, this process is relatively easy because the data is ordinarily disclosed to the market. In addition, these companies are often covered by equity research houses that prepare financial forecasts. In these circumstances, reviewing company announcements and brokers’ reports is all the ‘digging’ that is often required.

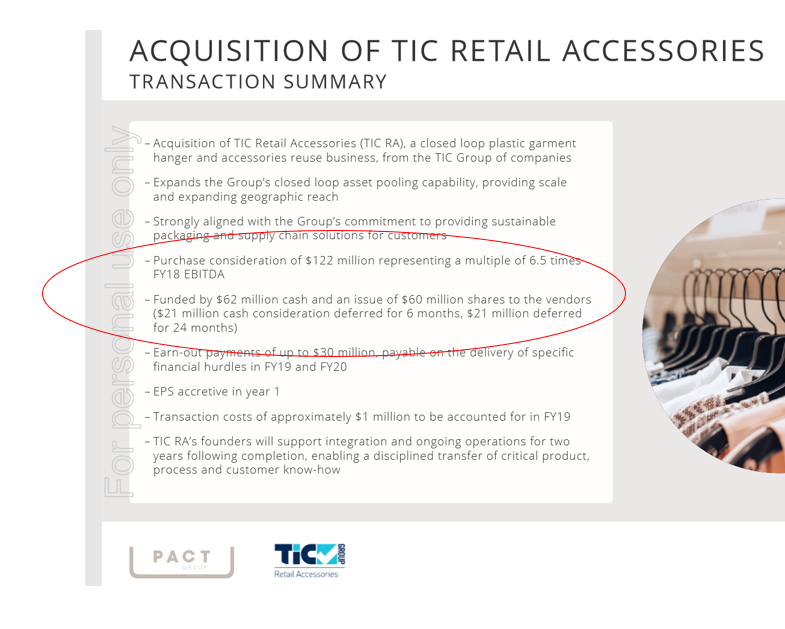

When at least one of the companies is publicly listed, it is still often possible to uncover relevant transaction and financial data from their company announcements. For example, the market announcement by the ASX-listed Pact Group of its acquisition of the privately-owned TIC Retail Accessories provided key details on the transaction that would be very useful in precedent transaction analysis:

When both the target and the acquirer are private companies, it is often difficult to obtain relevant data. In these circumstances, company blogs, media releases and news stories may offer some insight into the transaction. However, caution needs to be exercised when relying on this data, particularly with news stories that can be based more on rumour than fact.

3. Spread the relevant statistics and data

Once the relevant transactions have been identified and the necessary data obtained, the analysis is typically set out in a table.

Step 4: Identify the most comparable transactions

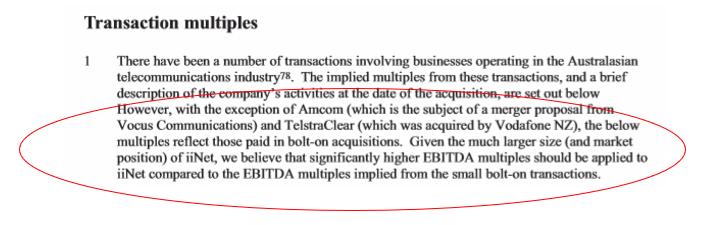

The next step is to then identify the most comparable transactions that can then be used to help value the target company. This stage of the analysis requires judgement to determine which transactions, based on the underlying characteristics of the businesses themselves and the specifics of the respective deals, are the most comparable.

Returning to the iiNet deal, the judgement exercised by the IER in picking between the identified transactions is captured in this paragraph from their report:

5. Determine the resulting valuation

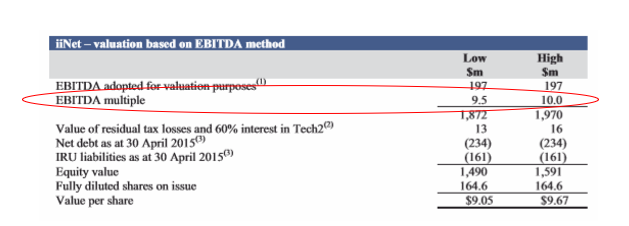

The final stage in the process of precedent transaction analysis is to use the insights gained to help value the target company. The analysis will help determine the applicable multiple that will be applied for capitalising the company’s earnings and arriving at a final value for the company.

While precedent transaction analysis is only one valuation tool that can be used when valuing a company, it is a very popular and useful method. If you would like to have a confidential discussion about how CFSG can assist you in successfully preparing for and completing the sale of your business, please contact us.