Our latest news and analysis.

How Investors Value Growth Companies

A common question we receive from company owners looking to raise capital is how investors value growth companies. Sometimes it is just as important to understand how they don’t go about it as it is to know how they do.

We were recently talking to a company in the environmental services space that was considering raising capital. It was a good business. It was profitable. It had solid systems and longstanding clients, and the owner had a clear plan for growth. And what a growth plan it was. Let’s say the business was earning about $5.0m in EBITDA. Based on a planned investment in new technology and expansion into new markets, the owner was forecasting EBITDA to hit at least $30.0m in three years.

That’s the sort of growth that gets prospective investors excited. It’s classic growth capital investing: buy in to a small but promising company at a relatively low earnings multiple, help the company to grow fast and then exit when the company is substantially larger and its earnings command an expanded multiple. That’s how private-equity-style investors can earn the sorts of returns that are harder to find in public markets.

So, what stands in the way of these sort of deal getting done? The biggest obstacle is when the company’s owner insists that his or her company should be valued as a $30.0m business and not a $5.0.m business.

In the case of the business above, the company had grown its earnings from circa $3.0m to $5.0m over the preceding three or four years. That’s nothing to be ashamed of but it is certainly nowhere near the kinds of growth the owner was now forecasting. He was specifically pointing to his new technology and the new markets that were going to be opening up to justify a very generous multiple.

Unfortunately, that’s not how sophisticated investors operate. They will buy into a business ‘as is.’ They will carefully assess the business’ current earnings, review the company’s historic growth rate and arrive at what they perceive to be fair value on that basis. So, in the case of the environmental services business we were talking to, they were earning about $5.0m and had been growing at about 15 percent per annum.

They are the metrics that a professional investor was going to punch into their models to arrive at a valuation.

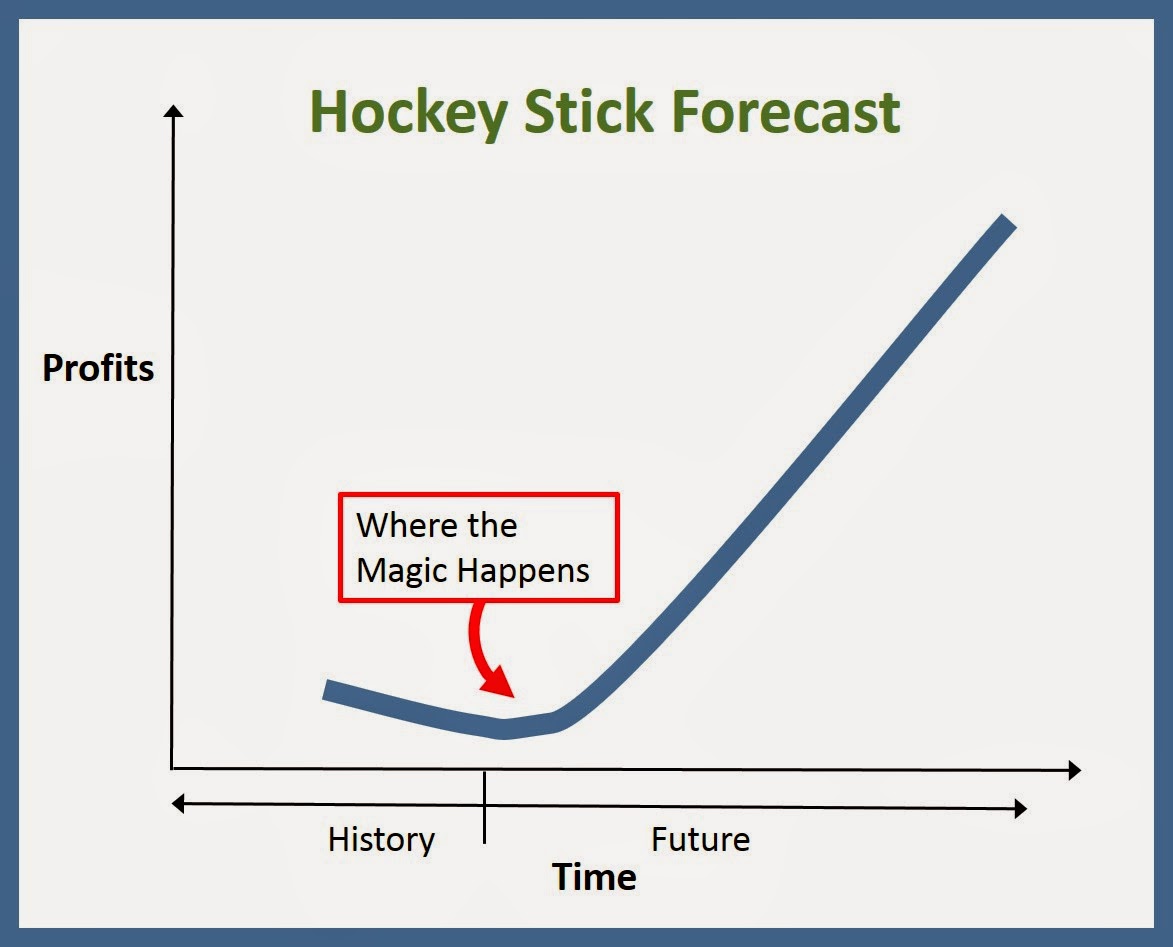

The founder simply couldn’t understand that. He insisted that they should be prepared to value his business as the super-fast growing, $30.0m-a-year business that he was convinced he was about to unleash. Why should they? It hasn’t happened yet. It’s speculative. It’s high risk. And if past performance is any sort of guide to future performance, there is a real chance that the rate of earnings growth will be significantly lower than the 500% being forecast.

Now, it’s the prospect of that growth that will get an investor excited. And it’s their level of confidence in the ability of the team and the plan to deliver on that promise that will ultimately get them to commit their capital. But they are not going to pay you for it before it’s actually happened yet. It’s like buying a run-down house and forking out as if it had already been renovated.

That’s not how the world works.

If you would like to discuss how CFSG can help you plan for and secure growth funding for your business, please contact us.